Your SAL membership

Unlock a world of knowledge, resources and connections

More than just a membership, SAL is your platform for growth, innovation and leadership.

Being part of SAL means joining a prestigious network of legal minds—from rising talents to esteemed industry leaders—all united by a shared commitment to excellence, integrity, and progress. It is a dynamic community to build connections and forge lifelong partnerships that shape the future of law in Singapore. SAL is your platform for growth, innovation and leadership. Stay connected to stay ahead.

Your SAL membership begins upon admission as an advocate and solicitor, appointment as a Legal Service Officer, Judicial Service Officer, or PD Officer, or registration or approval as a Foreign Lawyer.

Admission of advocates and solicitors typically takes place annually during the mass call, on a date set by the Registrar of the Supreme Court. Applicants will be notified of this date via a Registrar’s Circular. SAL also welcomes as Associate Members individuals who can benefit from, or contribute to, the work of SAL.

Disqualifications for SAL Membership

Please refer to the Singapore Academy of Law Act 1988.

Termination of Membership

Please refer to the Singapore Academy of Law Act 1988.

Termination of Associate Membership and Associate Student Membership

Associate members and Associate Student members can resign from SAL, giving one month’s notice in writing.

Associate membership may also be terminated by SAL under the following provisions:

- Section 16 of the Singapore Academy of Law Act 1988 – Disqualifications for membership.

- Section 18 of the Singapore Academy of Law Act 1988 – Termination of membership.

Associate Student membership shall also be terminated six calendar years from the date of his/her admissions an Associate Student member or upon his becoming an Ordinary Member, whichever is earlier.

Reinstatement of Membership

For members who have been granted waiver approval but would like to reinstate their membership before waiver expiry date, please complete the reinstatement form here and email us at [email protected]

Subscription fees will be billed for the full annual membership year when member no longer qualifies under SAL Rule 4 or upon reinstatement of SAL membership.

Waiver of Annual Subscriptions

By virtue of the Singapore Academy of Law (SAL) Rule 4, members may apply for waiver of annual subscriptions if (for any period of not less than 12 months), they will:

(a) be continuously absent from Singapore;

(b) not be ordinarily resident or domiciled in Singapore;

(c) not be in the profession of law; or

(d) not be gainfully employed.

Cessation of practice does not automatically result in qualifying for waiver.

Discover the diverse range of membership categories offered by SAL, each designed to suit various needs and interests.

Ordinary Member

- Admitted as an advocate and solicitor, whether or not he has in force a practising certificate;

- A Judicial Service Officer, Legal Service Officer or PD Officer; or

- A foreign lawyer who is registered or granted approval under the Legal Profession Act 1966.

Please refer to Terms and Conditions of Ordinary Membership.pdf.

Associate Member

- Qualified persons within the meaning of the Legal Profession Act 1966;

- Members of the academic staff of the faculties of law at the National University of Singapore, Singapore Management University and Singapore University of Social Sciences, who are not advocates and solicitors of the Supreme Court of Singapore;

- Lecturers or tutors in law at any of the other faculties of the National University of Singapore, Singapore Management University, Nanyang Technological University or Singapore University of Social Sciences, who are not advocates and solicitors of the Supreme Court of Singapore;

- Students of law faculties of the National University of Singapore, Singapore Management University and Singapore University of Social Sciences; and Singapore Citizens/PRs studying in universities set out the Legal Profession (Qualified Persons) Rules;

- Lawyers attached to offices of foreign law firms in Singapore, and foreign lawyers attached as in-house solicitors of businesses and companies in Singapore; or

- Other persons who can contribute to and benefit from the work of SAL, in the full discretion of the Executive Committee.

Please refer to the Terms and Conditions of Associate Membership.pdf.

Student Member

- Students in the preparatory course leading to Part A of the Singapore Bar Examinations conducted by the Singapore Institute of Legal Education;

- Students in the preparatory course leading to Part B of the Singapore Bar Examinations conducted by the Singapore Institute of Legal Education; or

- All students of the law faculties of the National University of Singapore, Singapore Management University and Singapore University of Social Sciences, and Singapore citizens and PRs who are full-time internal candidates, of the law degree programmes in the respective institutions of higher learning set out in the Legal Profession (Qualified Persons) Rules.

Please refer to Terms and Conditions of Associate Student Membership.pdf.

Subscription Fees

The Singapore Academy of Law (Amendment) Rules 2018 will come into force on 1 December 2018. Amendments to the Fourth Schedule will re-group SAL Ordinary members along the same categories adopted by the Law Society of Singapore and the Singapore Institute of Legal Education (SILE) from 1 January 2019 as follows:

Subscription Fees

The annual subscriptions (inclusive of prevailing GST)

are as follows:

1. Fellows

| S$1,090.00 |

2. Ordinary members where, at the time subscription is payable:

|

|

a. more than 15 years have elapsed | S$381.50 |

b. not less than 5 years but not more than 15 years have elapsed from the date of admission as an advocate and solicitor or appointment as a Judicial Service Officer, a Legal Service Officer or a PD Officer, whichever is the earlier date

| S$294.30 |

c. less than 5 years have elapsed from the date of admission as an advocate and solicitor or appointment as a Judicial Service Officer, a Legal Service Officer or a PD Officer, whichever is the earlier date

| S$130.80 |

3. Ordinary members who have foreign lawyers registered under section 36B or 36D of the Legal Profession Act or granted approval under section 176(1) of the Legal Profession Act

| S$381.50 |

4. Associate members who are persons other than law students | S$218.00 |

|

|

Please note that under a resolution of the Senate of SAL dated 19 January 1989, annual subscription for the first calendar year is waived for all new members |

|

|

|

5. No annual subscription is required for an Associate Student membership |

|

Honorary Fellow for Life and Member for Life

This title is SAL’s highest honours and is bestowed by the Senate of the Academy on distinguished members, recognising outstanding contributions to the legal and judicial system, and to the stature of the legal profession in Singapore. To date eight members have been conferred the title.

the late Mr Lee Kuan Yew

-

the first Prime Minister of Singapore

- in 1990

the late Dr Wee Chong Jin

- the former Chief Justice of Singapore

- in 1992

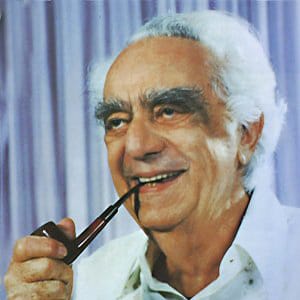

the late Dr David Marshall

- the first Chief Minister of Singapore

- in 1992

the late Mr Yong Pung How

- the former Chief Justice of Singapore

- in 2007

Professor S Jayakumar

- the former Deputy Prime Minister and Co-ordinating Minister for National Security

- in 2008

Justice Chan Sek Keong

- the former Chief

- in 2013

Justice Chao Hick Tin

- the former appellate Supreme Court Judge and Attorney-General of Singapore

- in 2018

Justice Andrew Phang

- the former appellate Supreme Court Judge

- in 2023

Fellows

- The President and Vice-Presidents of the Academy;

- With certain exceptions, all other members of the Senate;

- Persons who have since 1 January 1980 held office as Chief Justice, Judge of the Supreme Court, Attorney-General, Deputy Attorney-General or Solicitor-General for not less than two years;

- Honorary or associate members who are elected by the Senate as Fellows for life or for such period as the Senate may in any case consider appropriate; or Senior Counsel